Solar Panels

Looking to buy solar panels for your home and wave goodbye to high electricity bills and inconvenient power outages?

We’ve curated a selection of industry-leading solar panels and made sure that you also get all the components needed for a successful solar system installation. No guesswork, just complete solutions.

Explore Our Solar Panels

We’ve partnered with brands that boast proven track records in solar panel manufacturing, delivering consistent high performance across every U.S. zip code year-round.

-

Solar4America

550 Watt Bifacial Mono 144 Cell

Starting from $341

- Made in California, USA

- Bifacial design for higher energy output

- Long-lasting dual glass construction

- Sleek frame for extra strength

- Unmatched efficiency

-

ZNshine Solar

405 Watt Mono 108 Cell All Black

Starting from $247

- Tier-1 manufacturer

- 35+ years in business

- Stylish black-on-black design

- Top performer in reliability

- High efficiency at an economical price point

-

Qcells

410W Mono 132 Cell All Black

Starting from $332

- Assembled in USA

- World’s most efficient cell technology

- Attractive all-black design

- Designed to withstand extreme weather

- Superior quality and durability

What to Consider When Buying Solar Panels for Your Home

When shopping for solar panels, it’s critical that you consider size, type, efficiency, wattage, cost, and warranty. We simplify the process by breaking down what you need to know and look for.

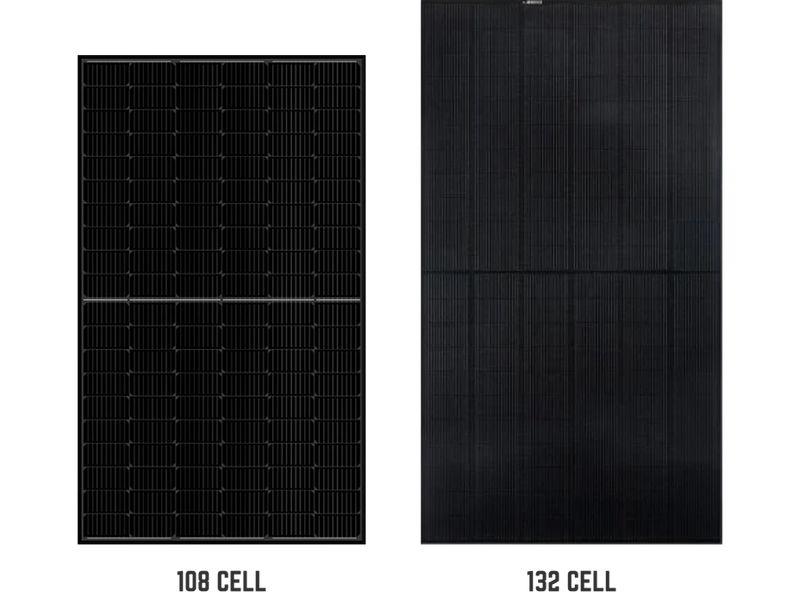

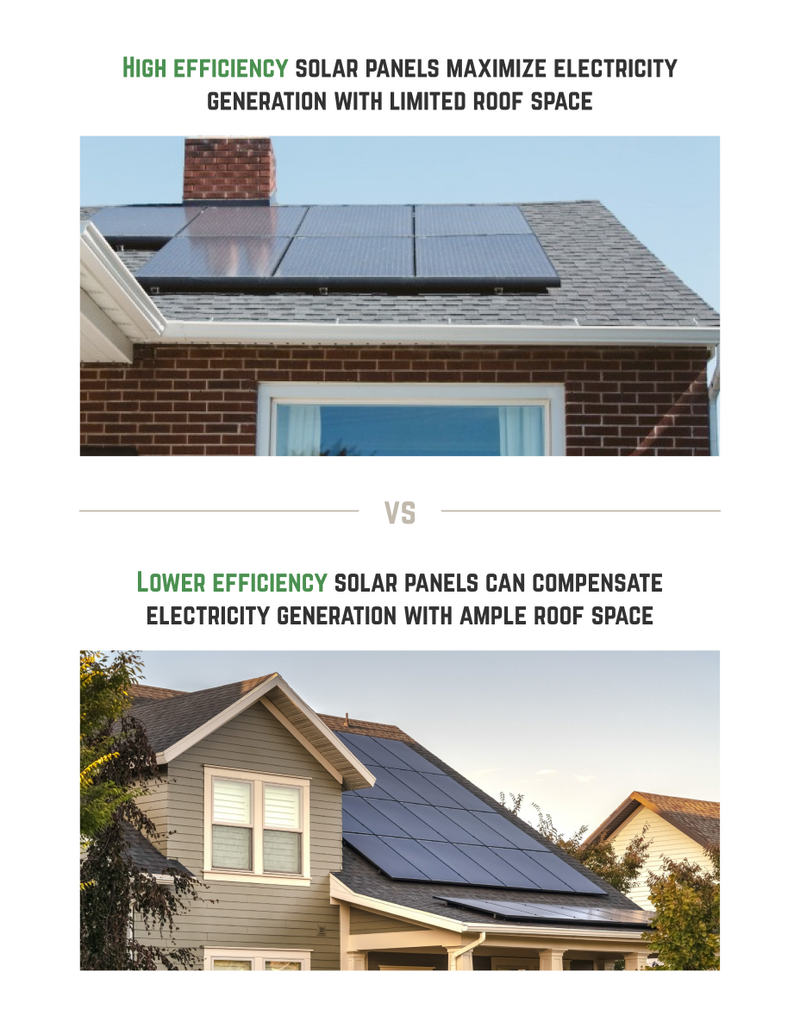

Solar Panel Size

Solar panels are available in various sizes.

The 108-cell panel, measuring approximately 68” x 45” and weighing around 45 lbs. is a popular choice predominantly for residential installations in sunnier locations across the US.

The 132-cell panel is bigger in size, measuring around 74” x 41” and weighing 48.5 pounds. Since it produces more energy, it is a good choice for maximizing energy production if you have limited rooftop space.

As both sizes work well for home solar systems, the choice depends on your available space. We recommend the larger size if you're installing a ground-mount system or if your roof can accommodate larger panels.

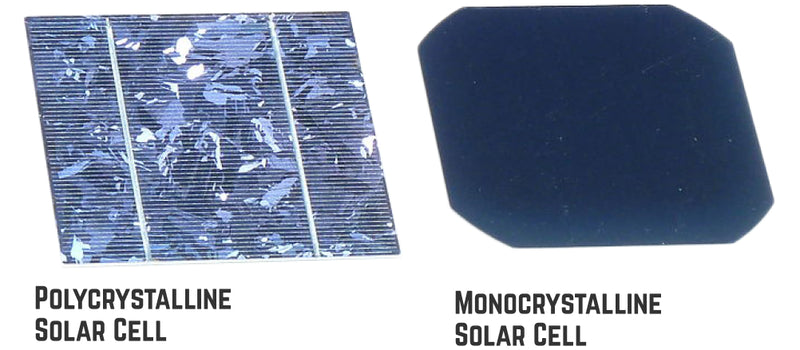

Solar Panel Types

Monocrystalline vs. Polycrystalline

There are two types of solar panels: monocrystalline (mono) and polycrystalline (poly) silicon. At GoGreenSolar, we offer mono solar panels exclusively, as they’re known for their higher efficiency and better performance in low-light conditions.

Learn more: Mono vs Poly Solar Panels

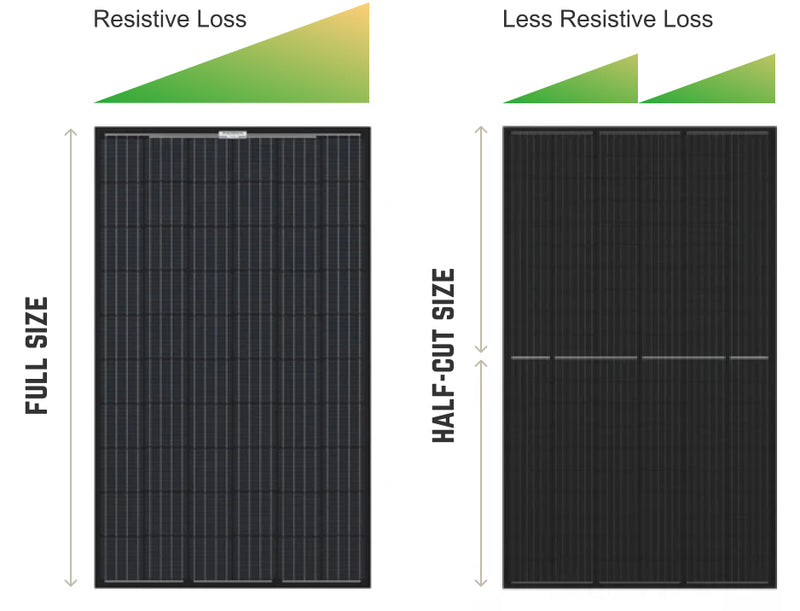

Half-cut Solar Cells

Half-cut solar cells are a recent breakthrough in solar technology. As electricity flows through wires and cells, some energy is dissipated. To mitigate this loss, a laser cutter splits traditional solar cells in half, enhancing overall performance. Half-cut solar cells effectively minimize resistive loss and improve efficiency, especially in shaded conditions.

Our half-cut ZNshine 108-cell panel is a customer favorite.

Learn more: Half-Cut Solar Panels Explained

Solar Panel Efficiency

High-efficiency panels optimally convert sunlight into electricity, delivering a more effective and sustainable solar solution for your home. On average, solar panel efficiency ranges between 15% and 20%. At GoGreenSolar, our panels achieve efficiency levels in the higher range, between 18% and 20%, making them ideal for those with limited space or anyone wanting to achieve their energy goals with fewer panels.

Learn More: Solar Panel Efficiency Explained

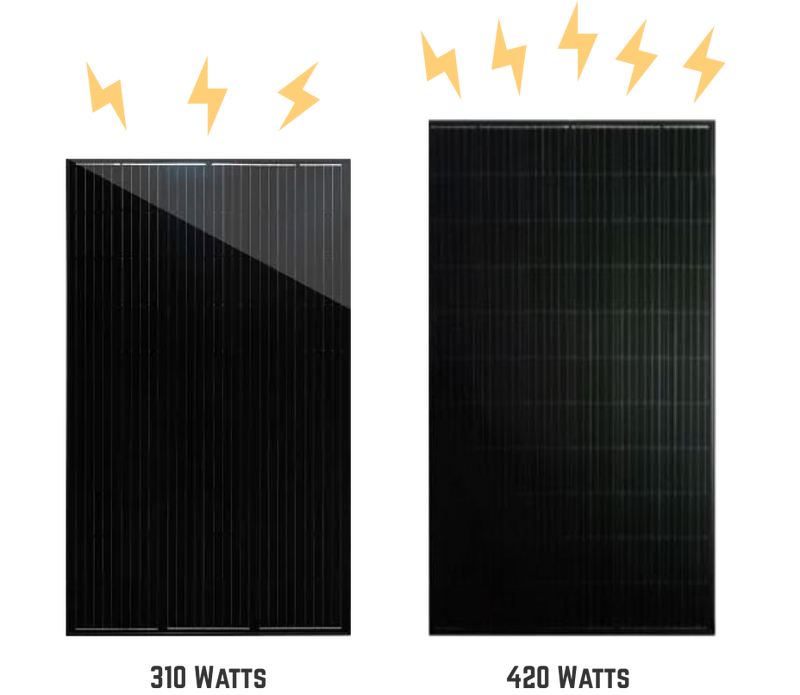

Solar Panel Wattage

Solar panel wattage indicates how much power a panel can produce over a certain time. Solar panel output varies widely, ranging from 250 to over 420 watts, with an average cost of 61 to 85 cents per watt.

At GoGreenSolar, we offer high-performance solar panels between 335 and 405 watts, ensuring you get enough to power your household needs.

Cost

Solar system prices vary, depending on the type of solar panels, manufacturer, cell size and wattage output. Our solar panels cost between $300 to $400 per panel, which is a competitive price considering the brands’ top-tier quality and high standards. Some solar panels can run as high as $600.

The total number of solar panels you need will depend on your home’s size and energy needs. Remember, solar panel prices do not include the cost of inverters, racking, and other necessary parts for a complete system installation.

That’s why it’s financially wiser to get a complete solar kit.

At GoGreenSolar, we’ll work with you to create a solar system that includes the best solar panels for your budget and energy needs. Your kit’s price will also include full tech support from our team as well as other services.

Take the first step: Calculate the Number of Solar Panels You Need

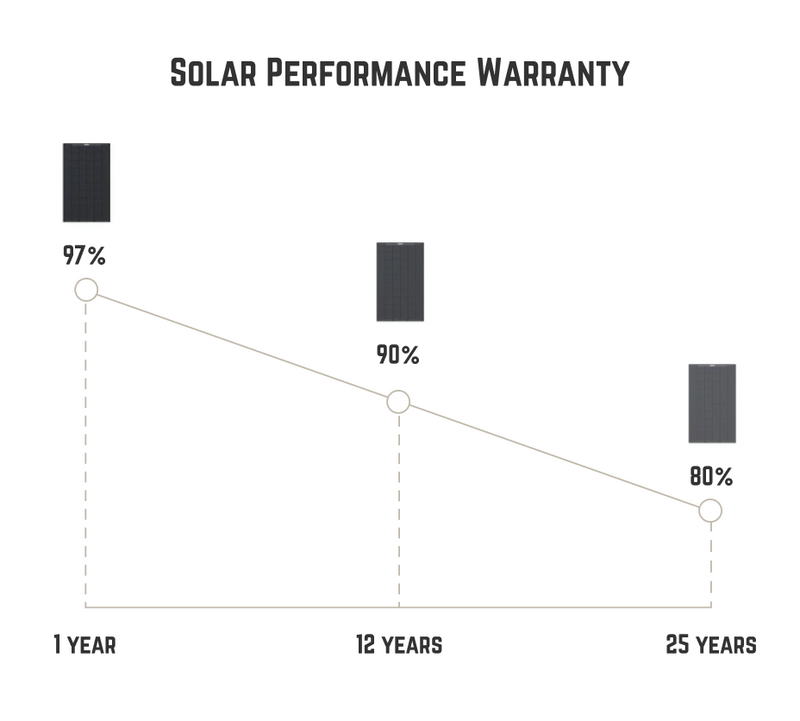

Warranty

Solar is a significant investment, so it’s crucial to understand how solar panel warranties work.

Product Warranty

A product warranty covers physical defects or faulty manufacturing. All of our solar panel brands offer a 10- to 12-year product warranty.

Performance Warranty

A performance warranty guarantees that your solar panel will continue to produce close to its intended output throughout the warranty period. All of our solar panel brands offer a 25-year performance warranty.

While panels, regardless of brand or wattage, naturally decrease output over time, the typical loss is limited to 10 to 20% over 25 years.

Learn more: Solar Panel Warranties Explained

Power Output Degradation

The example on the right shows a solar panel with a 90% power output warranty for 12 years and an 80% power output warranty for 25 years.

Should your panels degrade faster than anticipated, we’ll help you work with the manufacturer to get repairs or a replacement under warranty.

Learn more: Solar Panel Lifespan

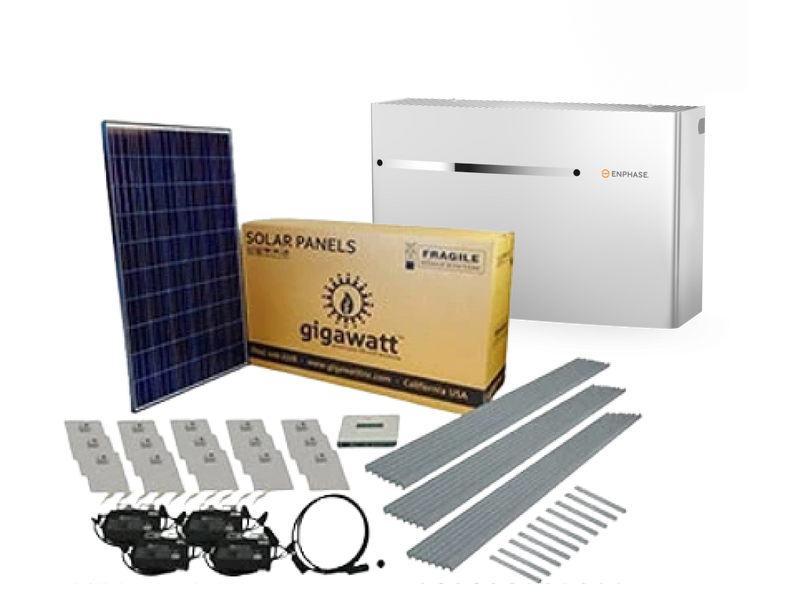

What else do you need besides solar panels?

Solar installation demands more than just panels; it requires additional equipment for a successful setup. Our solar kits include the necessary core components to kickstart your solar panel system.

Solar Panels

Solar panels harness the sunlight to generate electricity.

*Solar panels are not sold separately.

Inverters

Grid tie inverters convert DC to AC power – which is the type of electricity used in homes. They also provide net metering capability.

Batteries (optional but recommended)

Batteries can store excess energy when rates are low and use it during peak hours, optimizing cost savings. Moreover, during power outages, they act as a backup power source, ensuring uninterrupted electricity for critical needs.

Racking

Also known as mounting, it is a critical component that provides a sturdy and secure support structure for the solar panels.

Monitoring System

Track and analyze your solar energy production in real-time.

What Type of Solar System Do You Need?

Whether you need solar for your residential property or a remote off-grid location, we’ve got you covered with the latest and greatest technology.

-

Grid-Tie Solar Kits

Integrate solar power with your existing utility to reduce reliance on traditional energy sources and offset your electricity bill.

-

Battery Backup Solar Kits

Pair solar panels with energy storage for a self-sustaining system that offers uninterrupted power and peace of mind during outages.

-

Off-Grid Solar Kits

Experience complete energy independence in remote locations or areas without access to the traditional power grid.

-

Ground Mount Solar Kits

Set up your solar panel system on the ground for optimal sunlight exposure and efficiency.

-

Roof Mount Solar Kits

Save space while generating clean, renewable energy from the comfort of your home.

-

Microinverter Solar Kits

Maximize energy production with individual inverters for each solar panel to enhance system performance, flexibility, and efficiency.

-

String Inverter Solar Kits

This simple, cost-friendly solution is easy to maintain and ideal for homes or properties with minimal to no shade.

Which Solar System is best for you?

Why Choose GoGreenSolar?

Save Time & Money

Opt for convenience with our complete solar kits. They are customized for your needs, eliminating component compatibility risks and saving you money.

Get Expert Support

GoGreenSolar is the only solar panel distributor to offer expert support via phone or email in addition to affordable wholesale pricing and permitting services.

Experience You Can Trust

Our team has almost 20 years of experience designing solar systems for homes and businesses, so we can ensure you set up your solar right the first time.

Solar Calculator

Which Solar Kit Do I Need?

GET STARTED WITH SOLAR

WE’LL HELP YOU FIGURE OUT YOUR SOLAR NEEDS!

Fill out the form for a complimentary solar quote that includes a custom satellite layout, system design and a breakdown of total project cost and estimated savings.